On Monday, February 24, 2020 (a weekend for Russia), another gloomy news came from Europe. RBC, citing Bloomberg, reported that on this day the European stock market showed the maximum decline since 2016. The companies from the tourism industry and the manufacturers of prestigious consumer goods were especially sagging. In particular, shares of one of the industry leaders — Louis Vuitton Moët Hennessy (LVMH) — fell 7.2%.

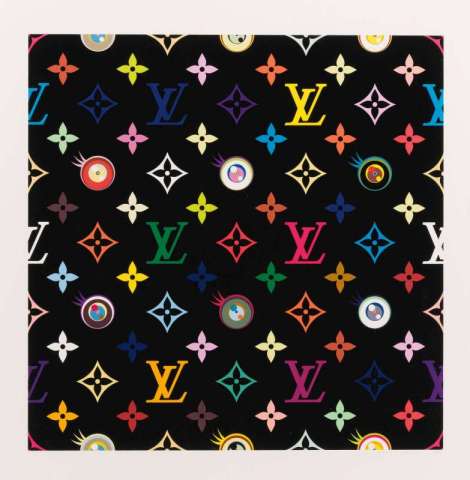

The reason is obvious. As we had guessed three weeks ago (see “Viral” crisis — 2020), the threat of coronavirus was too much underestimated. If greatly simplified, the main buyers of “luxury” in Europe (Chinese and other tourists from Asia) canceled trips. And given that the luxury market is intentionally poorly digitized (it is believed that expensive things should be shown only alive, surround the customer with care and “hold the button”), then the risk of the further dramatic reduction in sales is calculated.

With other markets, too, everything is complicated. Exchange oil prices fell by 4%, and after that in London fell the prices of shares of Russian oil companies and our leading banks. Approximately 3–5%. Tomorrow, on Tuesday, when the Russian exchanges open, this wave will reach us. The course will go to the area of 66–67 rubles per dollar. And stock prices of our champions may fall, perhaps even more than in London.

These are trifles so far. Will the real trouble pass by? There is hope. But it does not lie at all in the plane of epidemiological initiatives. The secret weapon of Russia may be the untapped potential of the economy and private initiative. In the sense that there is much to loosen long and tightly tightened nuts. In general, real tools to improve the business climate to the present have still not been used. Everything is only in words and on the TV. Therefore, if there is a desire to launch some kind of conditional NEP-2, then there are many untested options to really improve the business environment. Well, wait and see.

Vladimir Bogdanov, ASi

- Log in to post comments